Свинг 8 ответов на форуме Woman ru 5326219

03/10/2024Living with a Functioning Alcoholic Husband What Are My Options?

21/10/2024Whereas QuickBooks supports a quantity of currencies, it doesn’t enable direct worldwide funds, requiring users to seek out various solutions for handling global transactions. As a outcome, managing currency conversions, avoiding high bank fees, and ensuring compliance with global laws can be costly and time-consuming with out the right instruments. When dealing with international transactions, it is crucial to grasp the regulatory necessities and compliance standards that govern cross-border cash transfers. Incorporating strong security measures and utilizing dependable monetary institutions are very important https://www.quickbooks-payroll.org/ steps in mitigating potential dangers when transferring funds across totally different nations and currencies. When you accept international funds, QuickBooks information the entry utilizing double-entry bookkeeping with equal debits and credits (for your review).

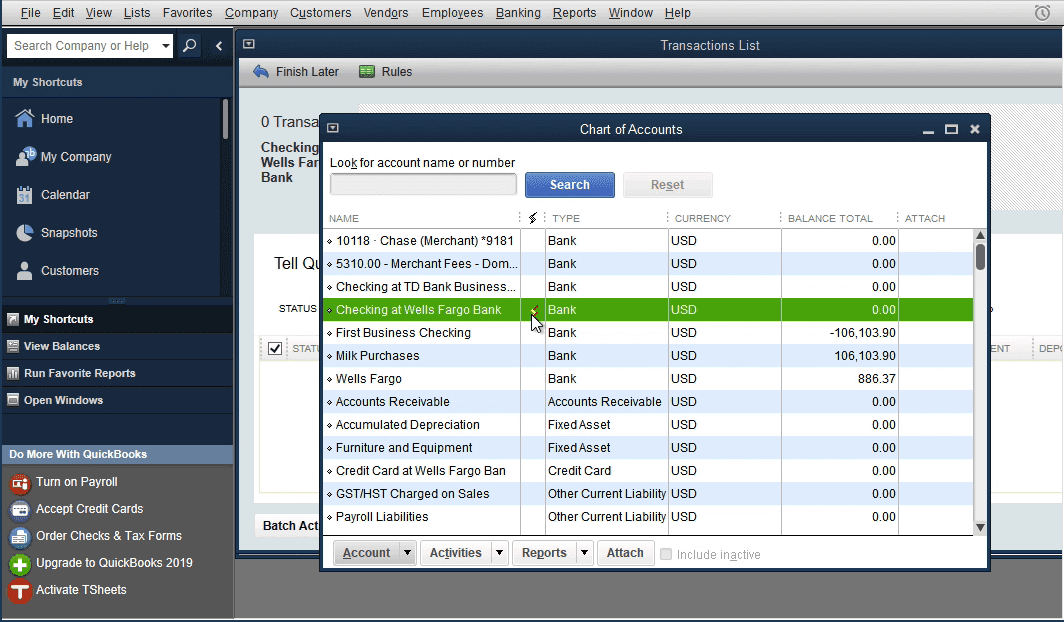

For companies managing multiple distributors, combining Invoice Pay automation with flexible payment choices can lead to smoother operations and better money administration general. To start, navigate to the ‘Banking’ menu and select ‘Bank Feeds’ adopted by ‘Set Up Financial Institution Feed for an Account.’ Then, select the financial institution where the ACH funds will be processed and enter the required credentials. Subsequent, choose the account to hyperlink with the bank and ensure that it is arrange for online companies.

Simplify International Funds In Quickbooks With Mineraltree’s Ap Automation Solutions

- For full steering, consult with certified professionals within the related fields.

- QuickBooks On-line streamlines vendor management by preserving billing, payments, and accounting all related in a single place, serving to companies stay organized whether they’re working domestically or across borders.

- Empower your purchasers to bill their international clients and assign multiple currencies to specific prospects, suppliers and accounts.

- QB Payments may be applied for and used through the QuickBooks accounting software program.

Your enterprise can make QuickBooks worldwide funds significantly nicely with an end-to-end AP automation software program integration. To settle for international ACH bank switch payments from clients, you want an add-on app because QuickBooks On-line lacks this characteristic. Consider Melio, PayPal, or Sensible for accounts receivable capabilities, corresponding to receiving worldwide payments from prospects.

Not solely does this characteristic simplify your international dealings, nevertheless it additionally retains your accounting extra correct. Trade rates fluctuate—having these routinely up to date in QuickBooks saves time and reduces errors. With your multicurrency capabilities now set up in QuickBooks, you can start to do enterprise with international clients.

You’ll likely use ACH or wire transfers when paying directly from a bank account. Other cost choices like credit cards are also obtainable however processed in one other way than wire and ACH transfers. Check with the QuickBooks third-party app to see their limitations on both technique, how briskly they typically execute, and what charges to expect.

What To Observe For With Cross-currency Payments

Feel free to learn these articles for more information about a quantity of currencies. Since you paid the JPY invoice using your USD account, you should report this transaction in your USD account as an outgoing fee. Handling currency change in your accounting system is crucial, FPADV. I have paid a supplier JPY invoice with the company USD account as we don’t have a bank account in JPY. I cannot believe that there isn’t a single business or individual in the QB neighborhood who exchanges money…Anybody some advise on the method to course of this normally? Earlier Than anything, know that I perceive how important it’s so that you can accomplish this as quickly as possible.

The Way To Troubleshoot Common Issues With Ach Payments In Quickbooks?

It mechanically updates change charges day by day to ensure that your transactions are as correct as today’s forecast. So far, you are one of the few users who requested about trade charges between accounts in the QuickBooks Neighborhood. In your case, I recommend contacting our Care Help team to help you in handling your books’ trade charges between accounts. This means, they take a better take a look at your books and suggest a bookkeeping service. Our global accounting software program helps accountants monitor clients gross sales tax on cross-border transactions with built-in global tax rates to help guarantee compliance with international tax guidelines. QuickBooks, owned by Intuit, is a one-stop shop for so much of accounting and bookkeeping tasks.

Before jumping in, it’s essential to know tips on how to enable this function. Activating multi-currency in QuickBooks requires a couple of considerate steps. It Is like stepping onto a one-way road, so ensure your business genuinely wants it.

Each transaction is routinely recorded, keeping your books up to date with out extra manual entry. As Quickly As a vendor profile is created, you may also set a most popular cost technique. If the seller prefers direct deposit, a mailed examine, or another methodology, QuickBooks enables you to record that preference, so you can choose the best choice automatically when it’s time to pay. The greatest benefit of using QuickBooks On-line for vendor funds is the seamless integration with your accounting data. Funds are mechanically recorded, vendor balances are updated, and monetary reviews are correct without having to re-enter info manually.

In Accordance to MineralTree’s ninth Annual State of AP Report, respondents cited AP as their number one automation priority within the again office for the fourth consecutive 12 months. This continued focus displays the important function AP automation plays in improving effectivity, lowering errors, and strengthening financial security and compliance. Go to your ‘Account and Settings’, discover does quickbooks accept international payments the ‘Superior’ tab, and there you’ll have the ability to enable the multi-currency function. Optimize stock, streamline manufacturing workflows, and reduce errors with real-time knowledge and cell options, enhancing efficiency and boosting profitability. Our CPAs are here to assist your business with strategic financial planning for financial evaluation, development and success.

It’s like maintaining a tally of visitors updates throughout a street trip to keep away from any detours. Your house forex is usually the foreign money of the country where your corporation operates or the place you file taxes. Increase your small business horizons and conquer worldwide markets with ease as QuickBooks empowers you and your clients to seamlessly navigate a number of currencies. Since the switch methodology didn’t work and does not change your steadiness sheet, you can create an expense transaction for 10,000 PHP and a 1250 RMB deposit as a substitute. QuickBooks can process funds in over a hundred forty five international locations together with the US, UK, Canada, Australia, and most European nations by way of its integrated cost solutions and partnerships with world payment processors.